Your success in accounting depends on how well you manage your clients and their money. It is particularly true if at least one of the businesses you serve is selling online or has international customers. Concurrent digital cash flows can cause a mess in data input and cross-border transactions only add to the mayhem. This hyper intricate process consumes more of your professional resources than it should. How many times have you caught yourself thinking about the ways you could spend your work time more efficiently by focusing on better service? That is where Synder accounting software comes to the rescue

Michael Astreiko, CEO and Co-Founder of Synder by CloudBusiness, serving thousands of accountants around the globe states, “When your clients move their businesses online and digitalise, then you have to follow. More and more accountants today are working with several e-commerce companies at once, who receive online payments through various gateways and in different currencies. It is a new reality for accounting professionals that requires flexibility and accuracy at a level higher than ever, mistakes can be costly. But this headache can be easy to avoid with the right automation software. The necessity to apply the right software shouldn’t be frightening to accountants. Technology can back you up, so you don’t have to worry about errors, and it ensures a seamless workflow.”

7 tips from Synder on how to manage multiple clients and avoid a mess in accounting

- Use smart software to manage multiple clients simultaneously

- Automate complex accounting processes to focus on top-notch service

- Store accounting data of all clients separately and avoid messy spreadsheets

- Set notifications to track accounting activity for every client

- Streamline accounting practice by adding free members to manage organisations

- Be agile in providing flexible price ranges to different clients

- Justify the price for professional services by providing solutions

Use smart software to manage multiple clients simultaneously

You welcome every opportunity to expand your accounting practice and warmly greet each new client who reaches out to you. But adding more clients comes hand in hand with intensifying strain in the established workflow. Handling multiple clients at the same time might look daunting without having the right technology as a backup. Sometimes it all becomes too much. Would you like to know how to avoid this problem? Funnel all the accounting data through a single automation program, like Synder. Synder provides a unique feature allowing accountants to manage multiple clients with separate pricing plans and different platform integrations with a single automation tool.

Two touchstones are essential for every accounting practice to thrive in 2021:

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData- automation,

- flexibility.

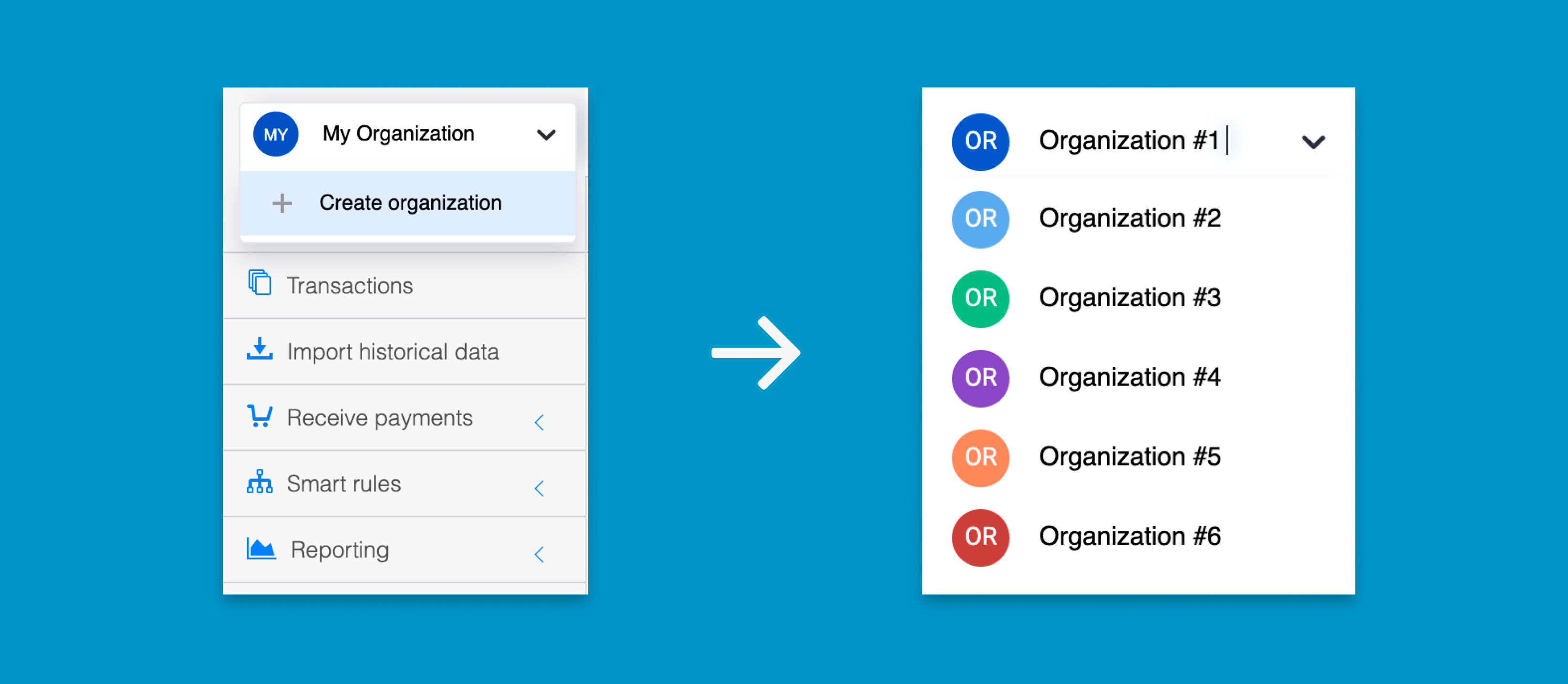

You can achieve better results with the support of the right technology. Thanks to using smart software, the accounting workflow will remain effortless, no matter how many companies you add or the number of platforms they receive payments. Each client’s transaction data is being smoothly synced in the background, accurately recorded in the accounting system and safely stored in Synder under a separate tab, called Organisations.

Automate complex accounting processes to focus on top-notch service

The beauty of using professional software is in the smart automatization of payment and accounting processes.

Choose the accounting system your client uses for bookkeeping — like QuickBooks Online or Xero and connect it to the payment platforms on which your client gets paid. Synder imports payment data from Shopify, Square, Stripe, PayPal, Amazon, eBay and other popular gateways. Multi-currency is not a problem either, as Synder software automatically adds conversion rates to the invoices and receipts. The whole workflow becomes accurate, consistent and well-ordered.

The underlying idea is simple and beautiful: delegate the lower-level work to technology. By automating complex and mundane processes, you can spend more of your billed time harnessing your professional skills to further enhance the quality of your professional accounting services. Instead of being the worker bee, step up to the manager role and lead your clients’ business finances more extensively and with a broader perspective. Start building more transparent, unique and trust-based relationships that will last.

Store accounting data of all clients separately and avoid messy spreadsheets

Do you want to provide outstanding service to multiple clients without compromising the accuracy of your spreadsheets? The Organisations feature in Synder is a solution that will help you keep accurate records without the extra stress.

Import and process data independently for every business you work with easily. Using Synder, each Organisations can be connected to payment platforms and accounting systems of their own. All online transactions synchronize in the background and get stored separately for every company in its own tab. You can connect each client to their own pricing plan, payment platforms and accounting system. But all of them will be gathered together under one interface, perfect for accountants.

No mess, no stress.

Set notifications to track accounting activity for every client

Looking to improve your accounting practice? You can start with the way you manage your clients. The reporting periods in accounting will be individual to different clients so proper planning will help improve the accuracy and precision of your services.

In Synder, you will get critical reminders for each organisation you account for via email. Notifications will inform you about the activity on your accounting app and you can choose how often you want to receive them.

To get even more out of this automation tool, turn on a reconciliation reminder. It will remind you monthly that it’s time to reconcile! Your accounting workflow will benefit from such timeliness.

Streamline your accounting practice by adding free members to manage organisations

Adding teammates or representatives from the client’s side to the accounting software is a wonderful way to build trustworthy relationships with clients and streamline the managing process. For each Organisations in Synder accounting software, you can have two free users.

People you invite to the Organisations can have different access rights depending on the role you attach to them.

- Managers have full control of the accounting workflow on Synder software. They can appoint and delete other users, connect new payment platforms, change pricing plans and subscriptions.

- Members have fewer access rights. They can sync transactions, create invoices and configure settings, but can’t add or delete other members.

Be agile in providing flexible price ranges to different clients

As a professional accountant, you know that no two companies are identical. All of them operate differently and have unique financial models. Businesses demand a more personalised approach and a better understanding of their accounting needs. Adapting to every client’s unique financial identity will help you earn more professional credibility and trust.

Use smart accounting software that can adjust to the needs of your clients. The question is, how to bill for it fairly and reasonably. The Organisations feature on Synder provides you and your clients with more flexible options for pricing plans and billing. Your accounting practice will be agile enough to adapt quickly to the changing demands of different businesses. You can decide to pay for the accounting automation services by yourself or let the client choose a better pricing plan and upgrade. The decision of one client will not affect other clients with different pricing choices on your Synder account. As a result, you will be able to bill clients differently depending on their unique business model.

Justify the price for professional services by providing solutions

As a professional in accounting, you get paid for your expertise, advice and assistance. Clients will be willing to pay more if you are improving their situation. Today, even the most experienced accountant can’t always perform their best without some automation software on hand. The reality of online financial flows has become too complex to keep trying to harness all this data without a proper technological back-up.

Accounting software is an integral part of this solution. Clients will value your services more if you provide solutions to their pain points. To find these opportunities, you also need to spend more time and energy on better communication and building stronger relationships.

Let your clients choose to pay for the accounting software from their side. This option is possible for every organisation in Synder. In this case, you will not have to include software expenses in your bill and can offer more of your accounting expertise. It can lay the foundation for more transparency and trust.

Bottom Line

The global e-commerce boom and transition of most businesses from offline to online will mark a new era for accounting services. The precision with each client’s data storage and avoiding mess in accounting when dealing with massive flows of online and cross-border transactions has already become a top priority. The right technology will make sure you pass this test.

Synder helps accountants around the world automate a significant part of data management, facilitating accounting practice and spurring professional growth. As a powerful synchronisation tool that connects payment platforms with accounting systems (like Stripe, Shopify, Square, QuickBooks Online, Xero and others), Synder automation software helps cultivate more agility in processes that tomorrow’s accounting will require for success.