Financial advice appears to be a family affair, as people are much more likely to find their own IFA, financial planner or wealth manager through a recommendation from a family member rather than a friend, according to new research from wealth manager Investec Wealth & Investment (UK).

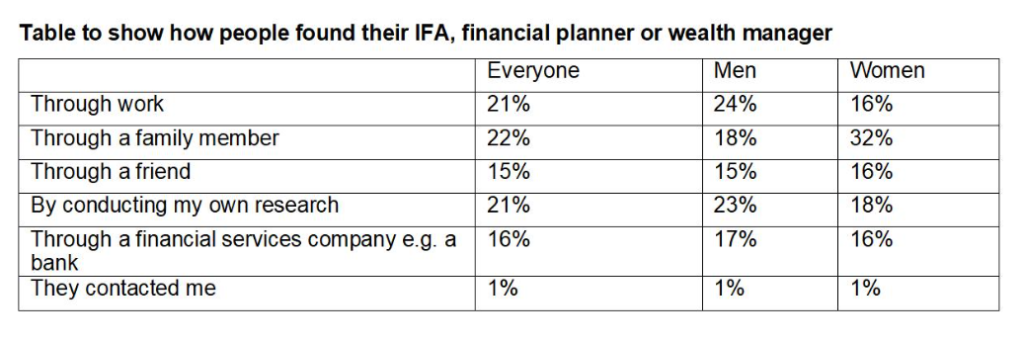

The study amongst 535 UK consumers with stock market related investments, found that over one in five (22%) found their IFA, financial planner or wealth manager via recommendation from a family member, or because a family member already uses them. This was closely followed by those who found their IFA or wealth manager by conducting their own research (21%) or through work (21%).

Fewer people found their IFA or wealth manager through their bank (16%) or through a recommendation from a friend (15%).

The research by Investec Wealth & Investment (UK), which provides products and services to help advisers build a competitive advantage and protect and grow their clients’ wealth, reveals this rises to around a third of women (32%) who found their IFA or wealth manager through a family member, compared to 18% of men. Men are more likely to find their IFA through work (24%) or through their own research (23%).

Investec Wealth & Investment’s study found that the average age to seek financial advice is 36 but that generally, men seek financial advice earlier in their lives than women. Men are, on average, 35 years old compared to women who are on average 41 before they start using an IFA, financial planner or wealth manager.

Those with a higher value of stock market related investments tend to seek advice earlier in life. The average age of those interviewed with over £1 million of stock market related investments was 26 when they first started seeing a financial adviser, compared to those with between £100,000 and £249,999 who were, on average, aged 39.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCommenting on this, Investec Wealth & Investment (UK) senior investment director, Nick Vaill, said: “Despite the ever-increasing ways in which IFAs and wealth managers are able to market themselves to new clients, our research shows that a family recommendation is still the most likely way for people to find themselves a financial adviser. There are many reasons for this – some people want to keep their financial affairs and even the fact they are seeing financial advice very private and for others, it’s only their family that they trust when it comes to making such an important decision.

“Adviser firms need to build capacity in their businesses to enable them to take on these new opportunities. Working in conjunction with a Discretionary Fund Manager has proven to be effective in doing this.”