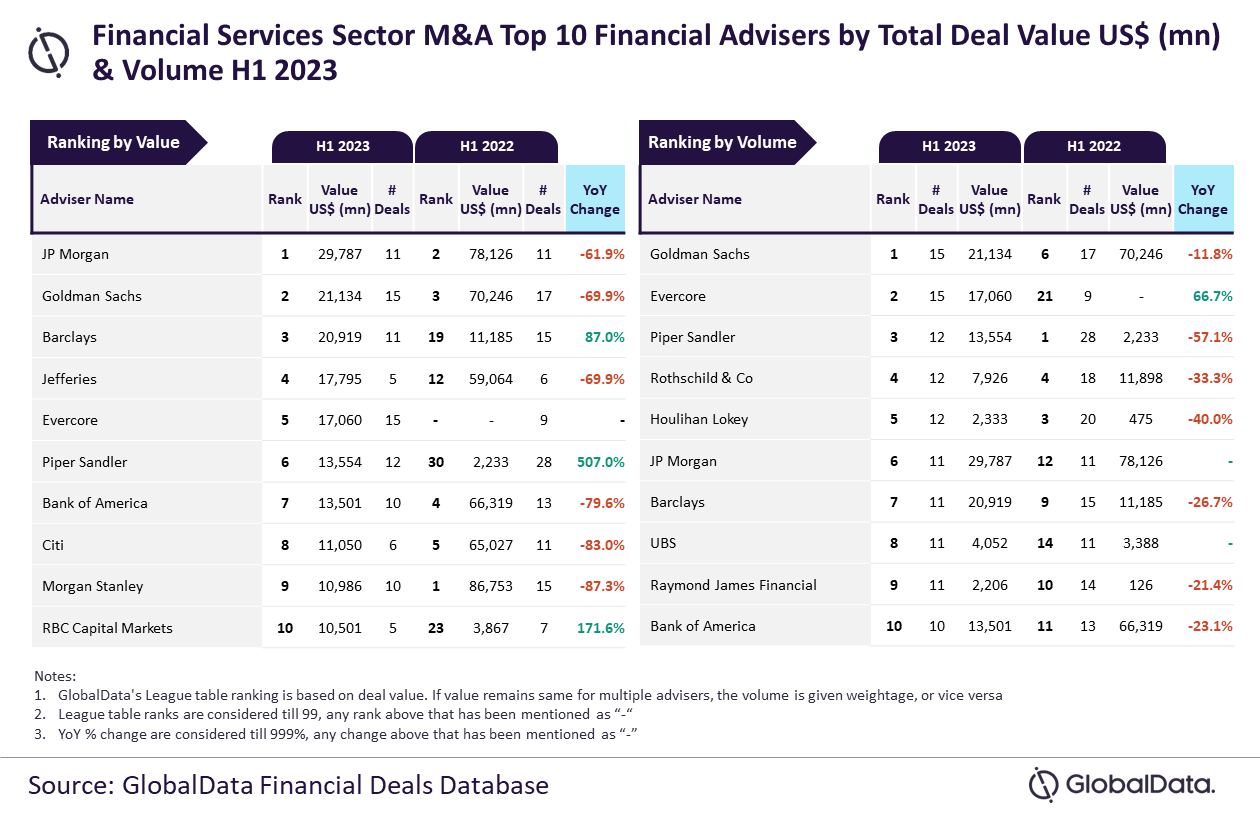

JP Morgan and Goldman Sachs were the top mergers and acquisitions (M&A) financial advisers in the financial services sector during the first half (H1) of 2023 by value and volume, respectively, according to the latest Financial Advisers League Table by GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that JP Morgan achieved its leading position in terms of value by advising on $29.8bn worth of deals. Meanwhile, Goldman Sachs led in terms of volume by advising on a total of 15 deals.

Commenting on this, GlobalData lead analyst, Aurojyoti Bose, said: “Apart from leading by volume, Goldman Sachs was among the only three advisers with more than $20 billion in total deal value in H1 2023. It advised on four billion-dollar deals*, which also included one mega deal valued more than $10 billion. Involvement in such big-ticket deals helped Goldman Sachs occupy the second position by value as well.

“Meanwhile, JP Morgan, which led the chart by value, advised on seven billion-dollar deals* that also included a mega deal valued more than $10 billion. In fact, JP Morgan was shy of around $200 million only from hitting $30 billion in total deal value in H1 2023.”

Goldman Sachs occupied the second position in terms of value, by advising on $21.1 billion worth of deals, followed by Barclays with $20.9 billion, Jefferies with $17.8 billion and Evercore with $17.1 billion.

Meanwhile, Evercore occupied the second position in terms of volume with 15 deals, followed by Piper Sandler with 12 deals, Rothschild & Co with 12 deals and Houlihan Lokey with 12 deals.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData