Businesses believe the desire to improve financial performance should be the single most significant factor behind companies introducing environmental, social and governance (ESG) strategies for the first time, a new survey has found.

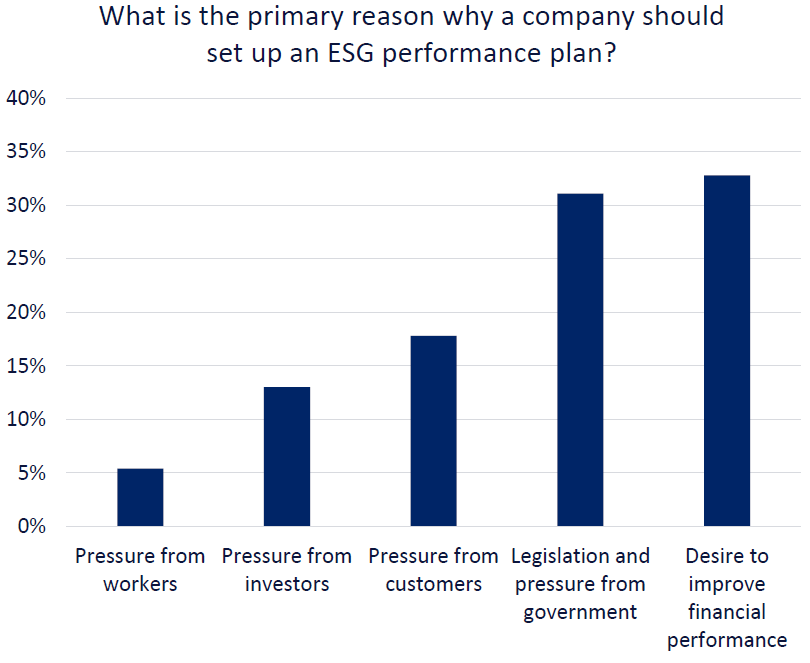

GlobalData’s Q2 2024 ESG Sentiment Survey found that improving financial performance was the primary factor for introducing an ESG strategy among a third (33%) of 354 cross-industry respondents across its network of B2B websites.

This was due in part to a fall in the perceived importance of legislation and pressure from government, which received 31% of responses – a 7pp decrease from the previous quarter.

ESG action as financial benefit

Contrary to previous industry sentiment that saw ESG as a financial burden, this survey indicates a wider shift to viewing action in the framework to be a business opportunity.

Several recent studies have shown that corporate ESG action can have a positive effect on a company’s financial performance. For example, a survey of more than 200 business leaders working on ESG found that 43% of companies with more than 10,000 employees reported financial returns including mergers and acquisitions efficacy, access to new capital and tax benefits, among others.

Similarly, the NYU Stern Center for Sustainable Business analysed the relationship between ESG and financial performance in more than 1,000 research papers from 2015 to 2020 and found a positive relationship for 58% of corporate ESG studies that focused on operational metrics such as for return on equity, return on assets and stock price.

Corporate sustainability action was found to drive better financial performance through effects such as higher operational efficiency, better risk management, more innovation, enhanced firm reputation and increased stakeholder reciprocation.

‘Pressure from customers’ and ‘pressure from the government’ have been the primary answers to the GlobalData poll since it began, except for Q4 2022, when ‘financial performance’ tied with customer pressure as the key incentive.

ESG concern falls behind inflation, geopolitics

Amid a landscape of rising regulation and litigation risk, ESG is becoming a central area of action for companies globally. GlobalData considers ESG the critical theme impacting businesses over the next decade.

However, the survey also included wider questions to gauge the significance of ESG in company operations and found that the theme remains a low priority for employees in the near future. Moreover, despite 63% of their companies having ESG strategies in place, 21% of respondents were unaware of them.

The report noted: “Companies need to engage with their employees when setting ESG strategies, as employee engagement is a key factor impacting the success of these plans.”

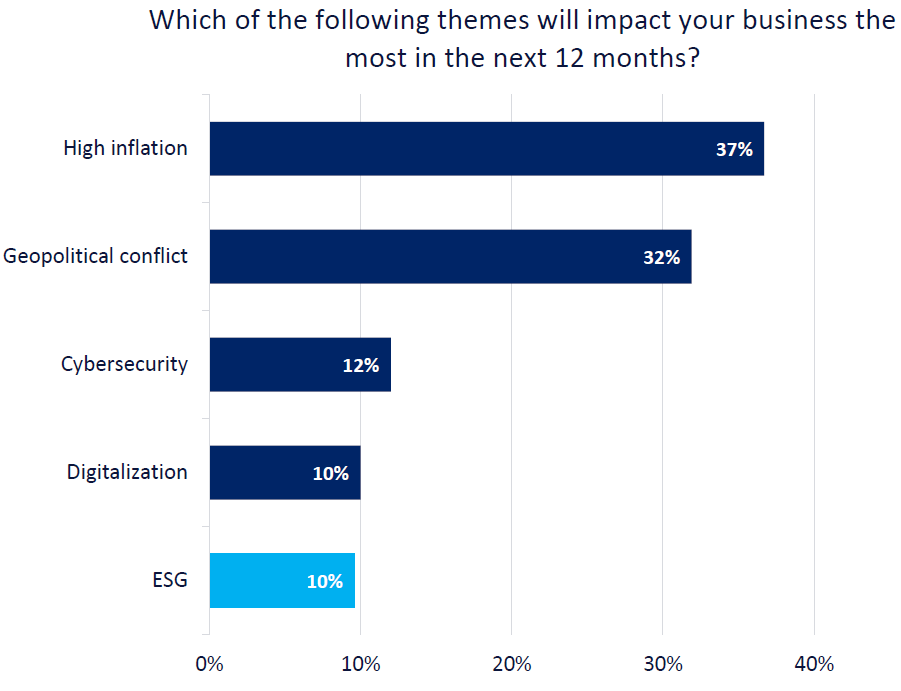

Only 1 in 10 respondents said that ESG is the most important theme for the next 12 months, consistent with results for the previous quarter. Instead, 37% of respondents ranked inflation first, followed by geopolitics, cybersecurity and digitalisation.

The proportion of respondents concerned about cybersecurity increased to 12% in Q2 2024 from 9% in Q1 2024. The report noted: “This coincides with several high-profile cyberattacks including against the UK’s Ministry of Defence and the Indonesian National Data Center.”

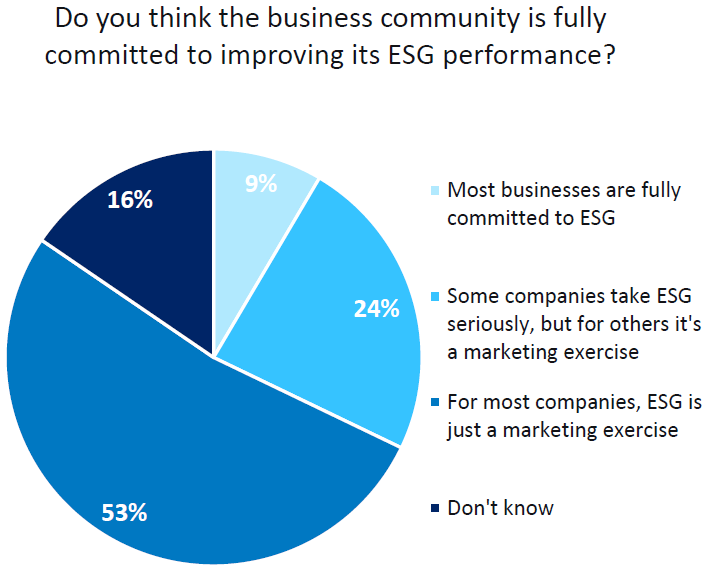

At 53%, employee sentiment that ESG is merely a marketing practice remains high, consistent with previous quarters, indicating a need for further transparency to combat greenwashing.